There are some things you can do to get most out it and reduce the time accountants spend chasing you for information, because we know how ruthless we can be (because we care!).

1. Combine files and ‘multi’

A quick way to upload multiple receipts is to use the ‘Multi’ function on the app, as each photo you take will create a new item in receipt bank. For invoices with multiple pages and 2-sided receipts use the ‘combine’ function.

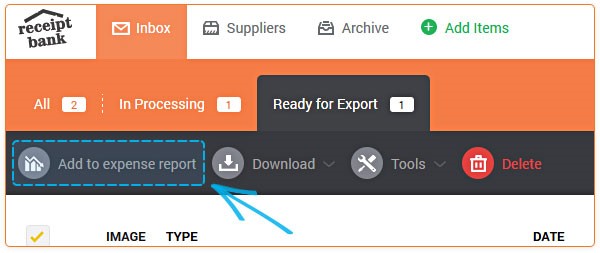

2. Use expense reports

Each employee can have their own Receipt Bank account, meaning they can snap expenses on the go. When these receipts are processed you’ll be able to see which employee uploaded them and quickly build reports for approval.

3. Only include one receipt per image

Each receipt is a single item in receipt bank so only photograph one at a time. Images with multiple receipts can get stuck in processing. The only exception is when you have a VAT receipt and card receipt for the same purchase… By doing this we can identify which card was used while avoiding duplicate expenses.

4. Always upload the VAT invoice/receipt when possible

If you’re VAT registered, you can only reclaim the VAT on purchases when you have a valid VAT receipt/invoice, showing the supplier’s VAT number. Credit card receipts, delivery notes, order confirmation and pro forma invoices are not accepted by HMRC as evidence for VAT purposes.

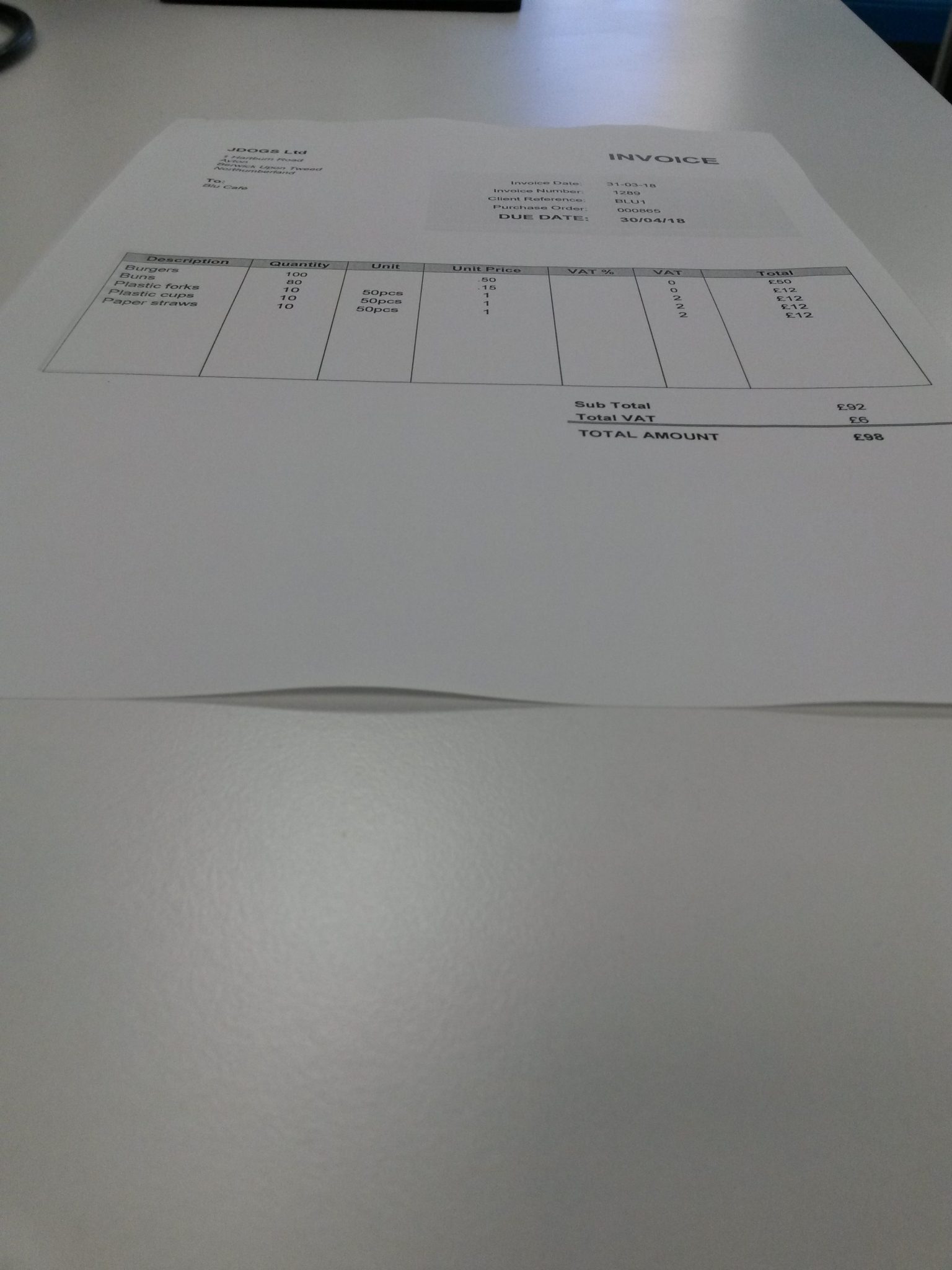

5. Ensure your photo is clear

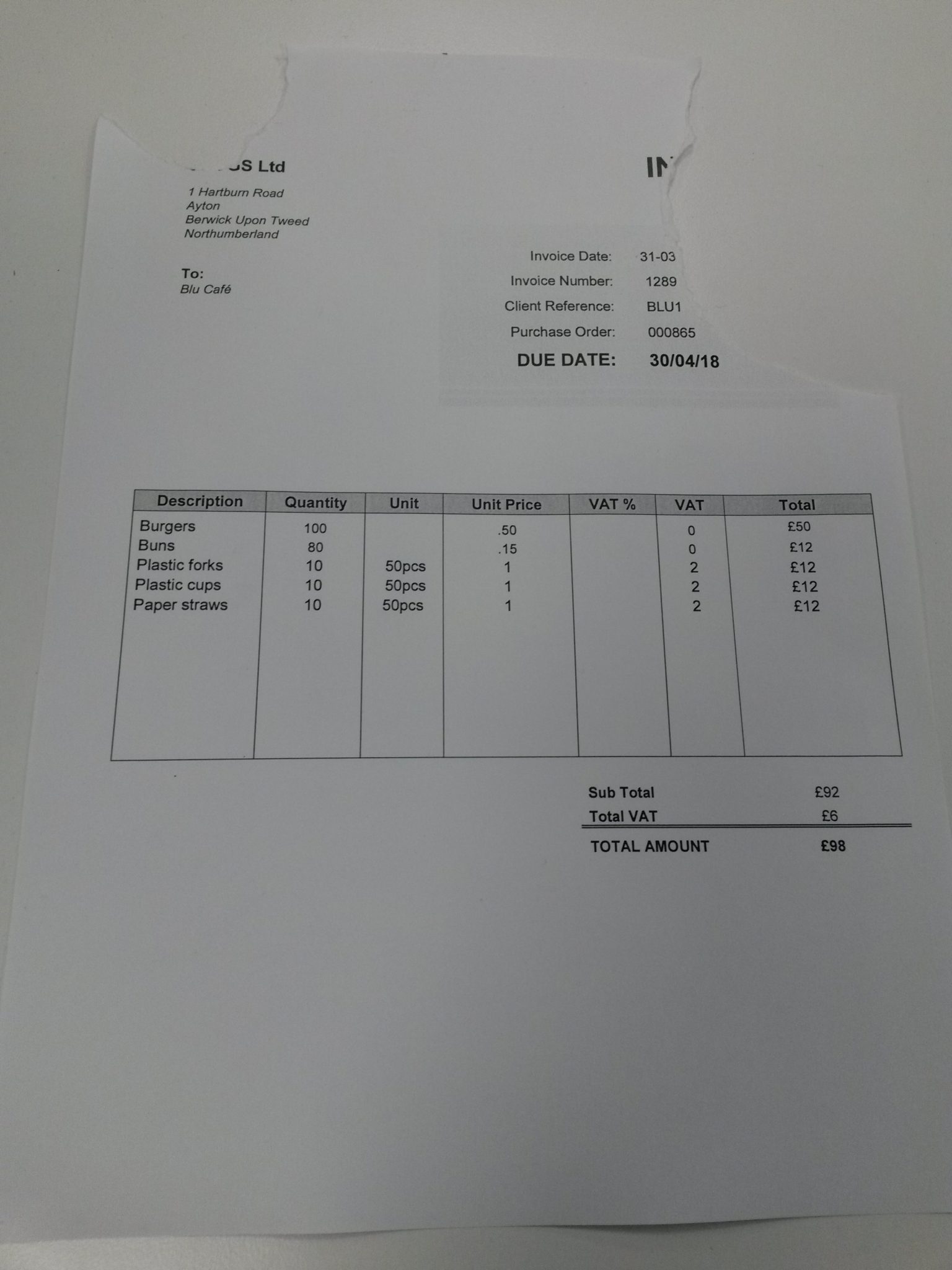

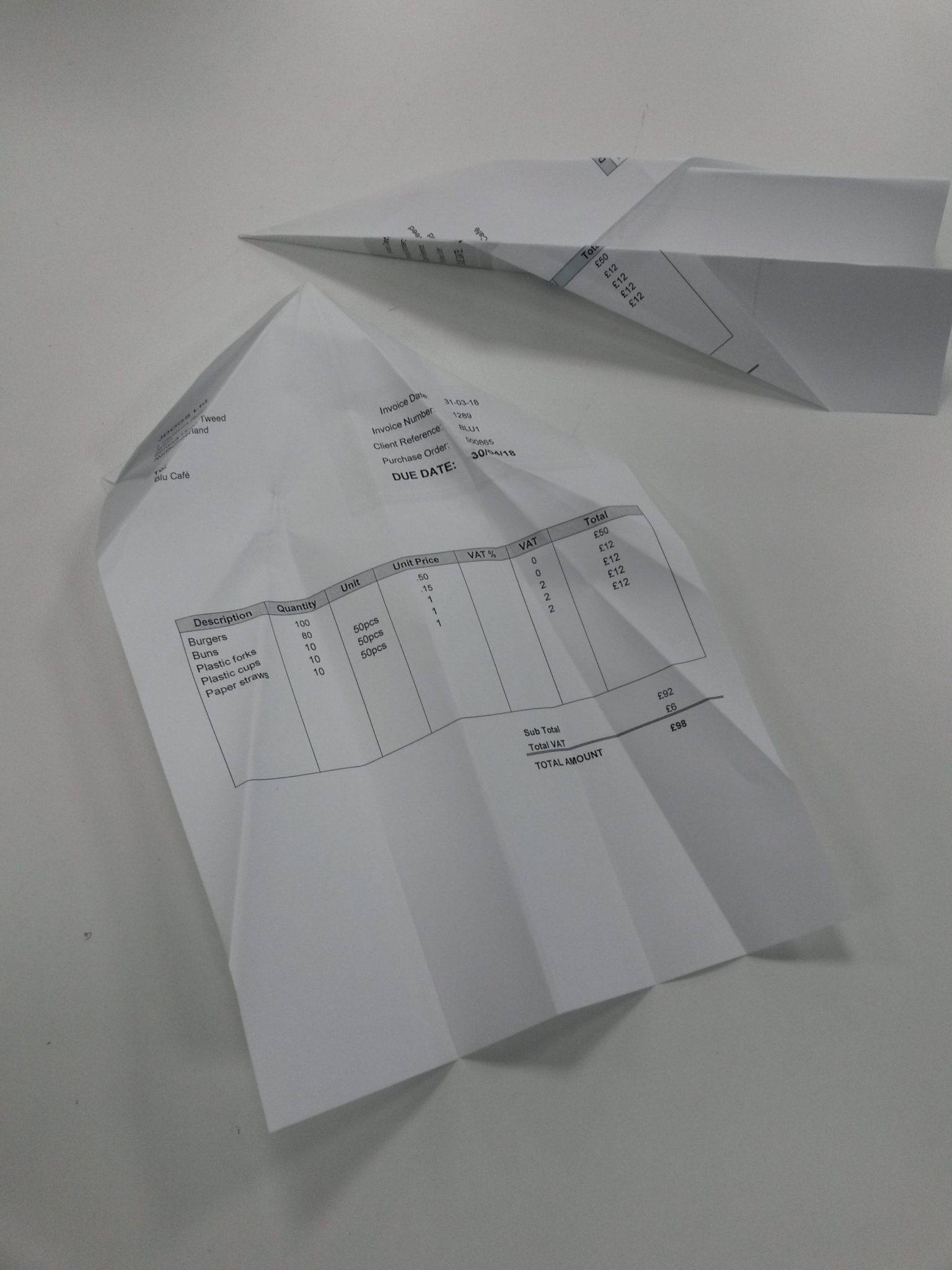

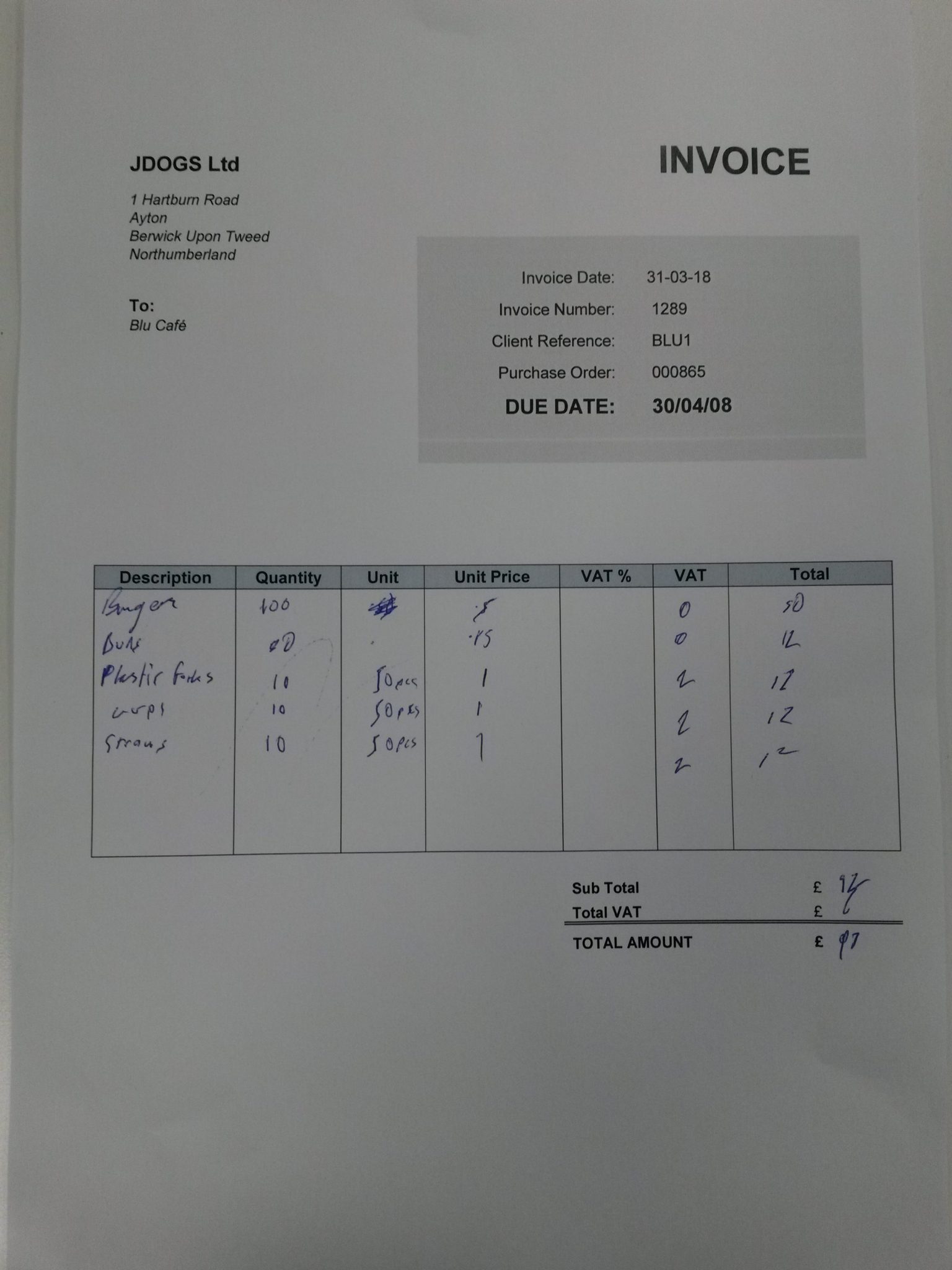

We can’t process invoices or receipts unless all the details are clearly visible. Before you submit an image for processing check that it’s not blurry, if you can’t see the details then neither can receipt bank. See below for some examples of unclear photos.

6. Email documents

If you use the same supplier for most of your purchases, ask them to email you invoices and statements. Most email providers allow you to set up forwarding rules, so why not forward these documents to your Receipt Bank address? That way, we will get the documents we need as soon as you do.

7. Do make notes & messages

Whether you’re telling us how something was paid or highlighting an accidental personal spend, notes can be very helpful. You can use the receipt description box to make notes and the messages function to discuss specific items.

8. Ask for a VAT receipt from big stores

Not all stores provide a breakdown of the VAT on their receipts, instead they’ll indicate ‘VAT-able’ items with an asterix (*) or specific letter. We can reclaim VAT on these types of receipts but it takes a lot of time to calculate. Instead, you can ask supermarkets for VAT receipt. The cashiers appreciate you asking ahead of them scanning the final item (we’ve learnt from experience!).

9. Upload other important documents

When you’re going through a mountain of paperwork with the app open and come across something that your accountant might need to see (like a letter from HMRC), just upload it and make a note! It won’t be published as an expense but your accountant will see it and have a digital copy for future reference.

10. Take care of your records

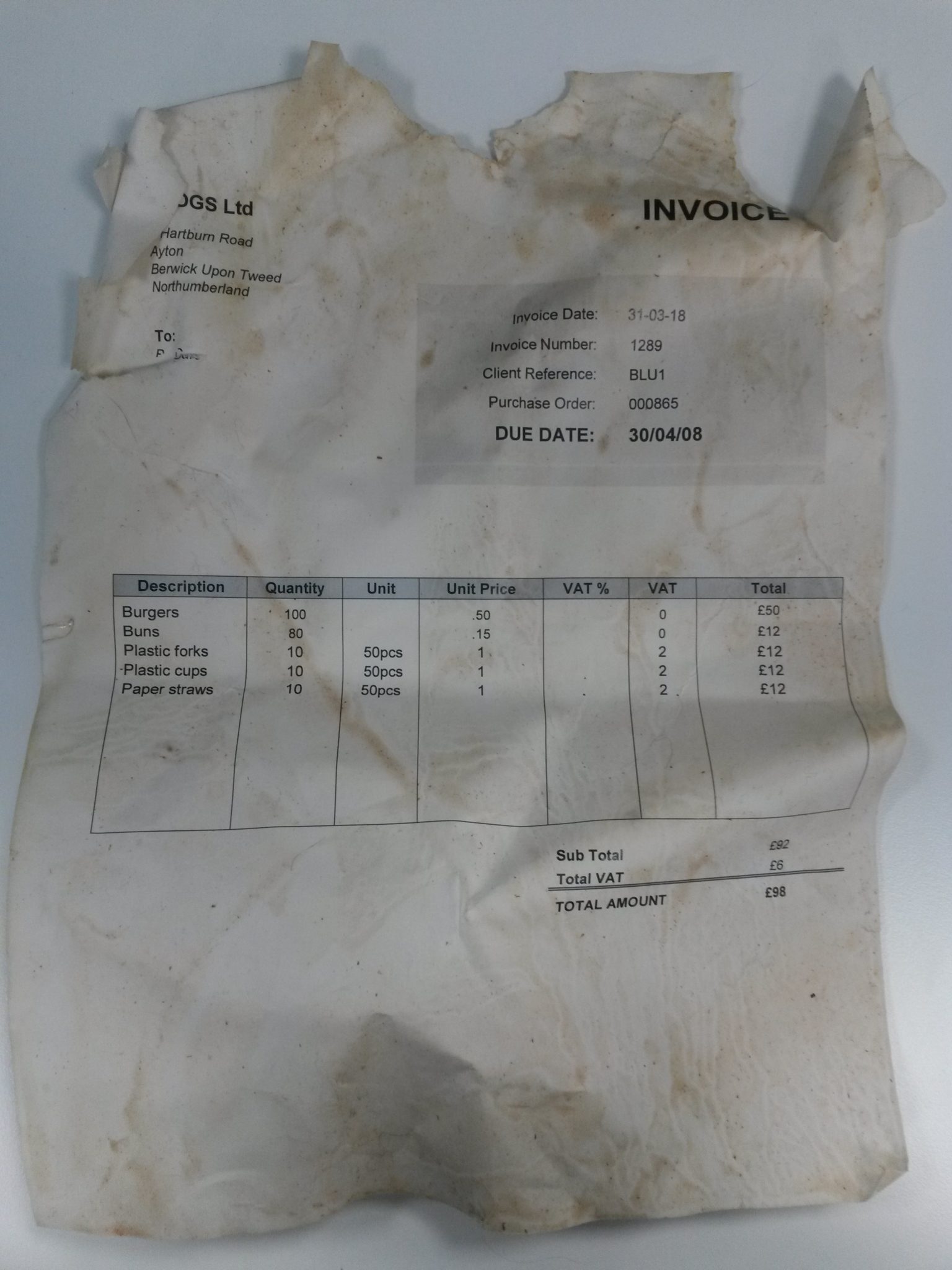

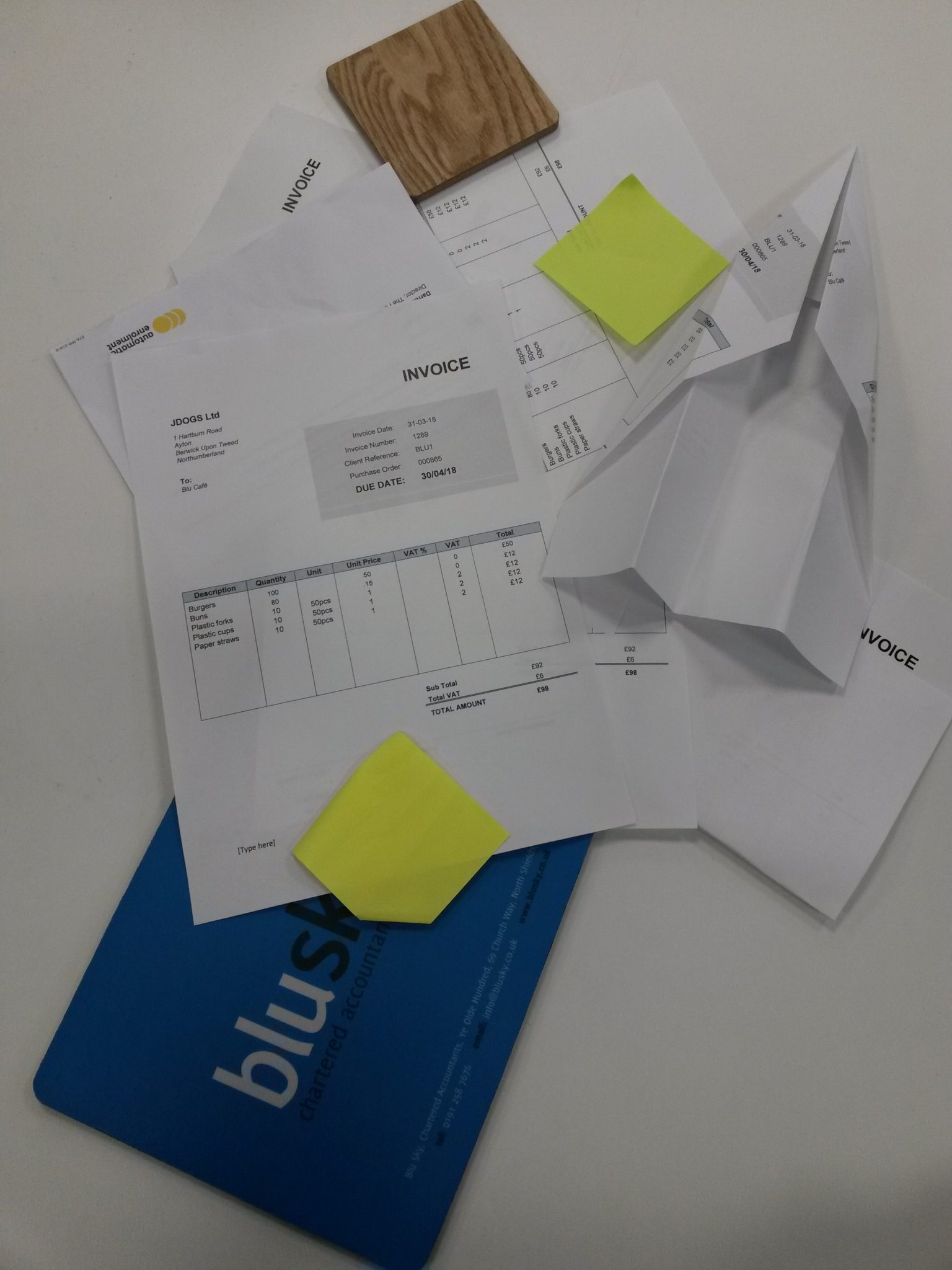

Tidy records mean accounts can be prepared sooner, fewer deadlines get missed and you have quicker access to information for things like loans and investments. Thankfully most records are nowhere near as bad as the examples below but some of them you might relate to!

Let’s take a look at a few examples that we sometimes see!

The Star-Wars intro

The one your dog ate

The origami

The handwritten one

The ancient scroll