There’s no doubt about it, electric cars are becoming more popular.

With fuel costs skyrocketing, and people looking at ways to be more eco-friendly, overall sales increased by over 76% in the last year.

In the UK, there’s an estimated 540,000 electric cars on the road and over 790,000 hybrids. As the infrastructure for electric cars continues to improve, people are naturally asking us for more advice on the benefits to their business.

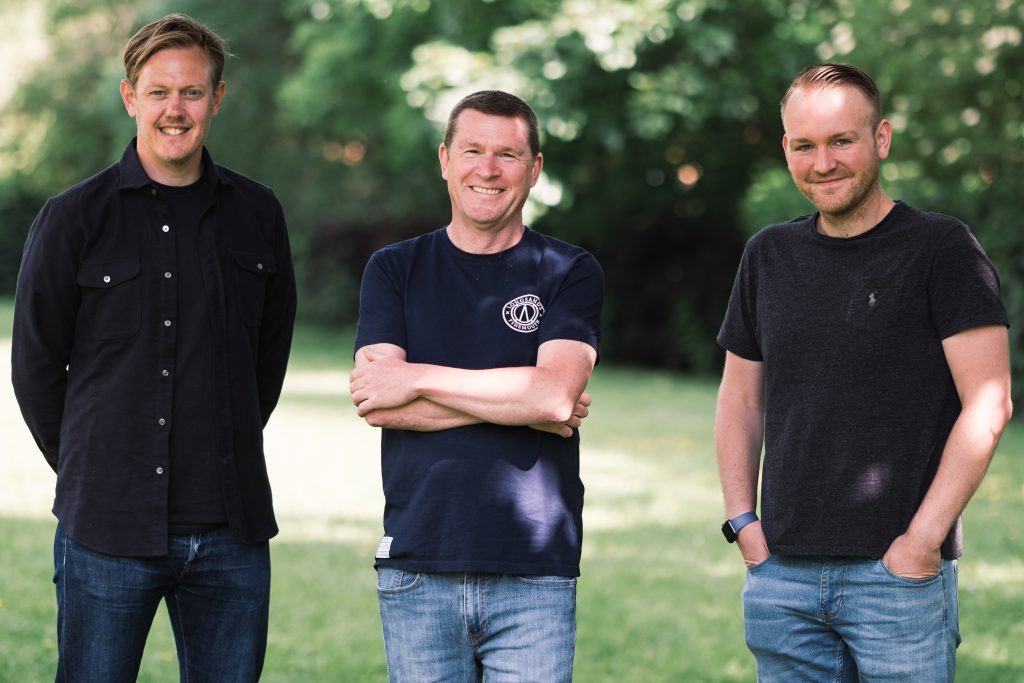

Our Client Relationship Director, Jonny, has an electric car himself. So he’s sharing his favourite electric car benefits for businesses and employees alike.

Take it away Jonny…

I’d just like to start by saying, as a massive petrol head, I was a bit worried about making the switch! However, it’s been one of the best decisions I’ve made. It’s good for the planet and it’s been very easy to adapt to.

Before we look at the benefits, let’s discuss why the UK government has made electric cars so attractive through tax incentives and savings.

Why offer electric car tax incentives?

The UK Government has committed to reducing emissions by 78% before 2035 and be net zero completely by 2050. One of the quickest ways to reduce emissions without requiring much additional investment, is to insensitive people to embrace greener travel.

If you think about how this works, the government can forego a little bit of tax revenue, and the car companies and energy providers are doing all the hard work for them.

All the vehicles and R&D costs are covered by the manufacturers. The infrastructure costs are paid for by the charger and energy providers rapidly trying to build the network.

For example, Shell has recognised that fuel demand will begin to drop as more people make the switch to electric. To combat potential loss, they’ve already started investing more into renewable energy generation and drawing up plans to convert petrol stations into EV charging stations.

By converting stations, they can still make a profit because people will still have a reason to go to their forecourts! So how can you get an electric vehicle through your business, and what are the tax savings?

How to save business tax through electric car leasing

As a business owner you can lease an electric car, by paying an initial deposit and then monthly lease payments.

- The cost of the lease comes out of the taxable profits for the company, which reduces your corporation tax bill.

- You can reclaim 50% of the VAT on the lease of an electric vehicle.

- This means that other than a P11d benefit, your company effectively incurs the cost of the vehicle. This reduces income tax on an individual as they don’t have to pay for their car privately.

- The only additional tax on the individual is the P11d benefit. On electric cars this is currently set at only 2% for 2022-2023 through to 2024-2025 tax years. See the example below of how this works.

How can buying an electric car save business tax?

Alternatively there’s the option of buying the car outright if your company has the cash available:

- If the car is bough outright the company can claim 100% first year allowance (FYA) on the value of the vehicle. This means that the full value of the vehicle can be deducted from taxable profits in the year of purchase, again saving on your corporation tax.

- Again, the only additional tax on the individual is the P11d benefit.

In short, moving to an EV through your company can be a very tax efficient way for you to remunerate.

Personal tax savings: Electric car salary sacrifice schemes

Salary sacrifice enables employees to sacrifice some of their gross salary for a fully electric company car.

As the sacrifice is before tax and National Insurance contributions are applied, employees effectively save on buying their new car. This works in a similar way that other savings such as childcare, gym membership or cycle-to-work schemes.

From a company’s perspective, this scheme provides an opportunity for you to offer employees a new car at a lower cost than the retail price. Your company may also benefit from reduced National Insurance contribution payments from the scheme.

Fully managed salary sacrifice schemes

There are fully managed salary sacrifice schemes out there from the likes of Tusker, Octopus EV etc. These allow employees to pay for the car lease payment, insurance, servicing and tyres (there is no road tax on EV’s) monthly through their payslip.

Remember that your employees save both PAYE and National Insurance on any amounts sacrificed on the monthly lease payment at their income tax rates.

This type of scheme greatly reduces the admin you need to do as they are fully managed. You’ll usually have an account manager for the scheme who sorts everything for you.

Example P11d benefit tax on and individual vs the recent company car favourites:

Tesla Model 3 Long Range

- Electric Range: 374 miles

- List Price: £49,990

- Emissions: 0g/km

- BIK Rate: 2%

- BIK: £999

- Tax payable 20% tax payer: £199 per year

- Tax payable 40% tax payer: £399 year

BMW 330e xDrive M Sport Saloon (Hybrid)

- Electric Range: 38 miles

- List price: £44,985

- Emissions 113kg/km

- BIK rate: 12%

- BIK: £5,398

- Tax payable 20% tax payer: £1,079

- Tax payable 40% tax payer: £2,158

BMW 320d M Sport Saloon

- Electric range: N/A

- List price: £40,280

- Emissions: 124g/Km

- BIK rate: 28%

- BIK: £11,278

- Tax payable 20% tax payer: £2,255

- Tax payable 40% tax payer: £4,511

Finally, here are my personal top five electric car benefits

No petrol stations

- Not having to go to a petrol station!

- Charging the car overnight on the drive is just so convenient and much less hassle, also with the price of petrol/diesel increasing its saving me a small fortune.

A growing charging network

- The charging network is growing rapidly, most towns and shopping centres now have plenty chargers, all service stations and motorway networks have a load of rapid chargers now so long-distance journeys are also breeze.

Good to know:

-

- If you’re based in the North East, the metro centre commissioned a 50 charger EV only car park, where the roof to the car park is made up of solar panels that provide the energy for the cars – how good is that!

- If you’re in London, EV’s are exempt from the congestion charge until 2025, and the charging infrastructure is already fantastic.

No de-frosting

- Never having to de-ice or scrape the car, most EV’s come with an app that allows you to pre-heat the car, so whilst I’m having my brekky I set the car to defrost, turn the heated seats and steering wheel on. The car is then lovely and warm to jump into and drive straight off.

EV specific tariffs

- Most energy providers now offer EV specific tariffs, with reduced prices for charging at off peak times (usually overnight) and via renewable energy only.

- This is effective in two ways! It reduces the pressure on the national grid at peak times and allows the UK to utilise the surplus renewable energy it makes overnight without having to store it.

- Plus, it gives you a discounted rates during this time.

As a guide I pay roughly £4 for a ‘full tank’ in my Tesla, giving me 300+ miles of range, this would have cost about £90 in my old car!

Great to drive

- They’re fun to drive, don’t really need servicing and have very little maintenance requirements.

- Other than replacing a set of tyres and you don’t really need to do anything. As an extra bonus they’re even exempt from Road Tax! All whilst doing your bit for the planet.

Want to know more?

If you’d like to discuss moving to EV’s in more detail please contact your client relationship director who can walk you through the numbers.