Today’s weather is grim, the economic outlook is grimmer, and today’s autumn statement – the November 2022 budget is the grimmest of the lot! But there is some sunshine behind those clouds.

We’ve had a few weeks of the usual speculation, but now we know what’s in store, Dave’s watched, read and digested it all so you don’t have to. Here’s what today’s November budget means for Blu Sky clients and business owners.

To Summarise

In general, in the words of Soccer AM, “change is not good”. There’s very little to help the SME market here, whether you work in tech, services, or hospitality, and whether you’re looking to start a business up, or to exit. Inflation will continue to tug at your purse-strings through 2023 but we hope will drop significantly thereafter.

There are some upbeat noises for innovative companies, but little or nothing to help motivate innovative people.

Recession is here, and probably here to stay for a while. Well managed businesses with a purpose, a roadmap and the right financial processes will probably survive, and indeed, as we’ve seen through lockdown, many will thrive.

At the risk of sounding like a broken record, keeping your finances up to date, using good quality management information and owning/reviewing a forecast are key items in your toolbox. Money will be harder to get hold of, so managing your cashflow becomes even more critical.

Those without the above are in danger of steering blind.

A quick summary for you as a business

The November 2022 budget will bring a few changes. There’s more tax to pay, either through increasing rates (Corporation Tax, reducing R&D relief, possible impact of increase in national minimum and living wages) or through fiscal drag (freezing NIC secondary rates but increasing wages).

Quick summary for you as a person

More of the above. Either more tax to pay over time through fiscal drag (freezing rates) and lower points at which dividend or capital gains tax thresholds start. However there is the promise of (reduced) support for domestic energy bills beyond March.

On to the detail then, what does the November budget mean to Blu Sky clients:

Personal taxes

The current freeze on income tax and inheritance tax thresholds will be extended (for a further two years) to April 2028. The broad principle is that those who can afford it will pay more. In practice anyone who pays taxes will probably pay more. The theory doesn’t necessarily tie in with freezing the start point at which you pay income tax and national insurance at its current level (£12,570). The Treasury’s own figures show that 55% of households will pay more tax.

The OBR (Office for Budget Responsibility) response makes for interesting reading and if we had a couple of days extra spare I’d love to bring more of their analysis into play.

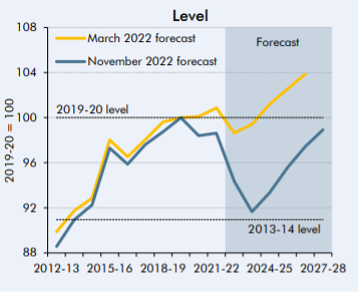

Here’s their thoughts on household disposable income:

There are no changes to tax rates.

Not strictly tax – more of a give-back, but the EPC (Energy Price CAP) will still exist in April, but will increase from it’s current level of £2,500 for an average household to £3,000 – a 20% increase. This will be almost three times what it was two years prior, in April 2021. There will be further targeted support through 2023/24.

The income tax additional rate of 45% will from April start at £125,140 rather than it’s current £150,000. At the same time – and impacting more of you – the Dividend Allowance (i.e. the amount you can receive without paying tax, currently £2,000) will halve to £1,000 then in April 2024 halve again to £500. At that point it will have reduced by 90% from it’s starting point of £5,000 when dividend taxation was revamped in Finance Act 2016 and the ‘notional tax credit’ was abolished.

Following similar lines, the November 2022 Budget brought changes to capital gains tax allowance. It will also halve in April to £6,000, then halve again to £3,000 in April 2024.

The proposed stamp duty help announced in the ill-fated mini-budget will remain until April 2025. This provides some weak help to the housing market, but the OBR forecast average house prices to have dropped by 9% by Q3 2024, driven by both the downturn and higher mortgage interest rates.

There will be further inflationary increases for company car, van and fuel benefits. Electric vehicles will also pay excise duty from 2025.

Business taxes

As previously confirmed, the planned April increase in the Corporation Tax rate to 25% for companies with over £250,000 in profits will go ahead. There’s a sliding scale between 19% and 25% for profits between £50,000 and £250,000.

So usually, if you’re profitable and have a March year end, we’d be telling you to buy what you need to buy before the end of the financial year. Now it might just be worthwhile putting back to April.

Despite the continuation of AIA at £1m, the OBR believe business investment in 2022 was still 8 per cent below pre-pandemic levels and expect it to fall further in 2023 as it is held back by higher long-term real interest rates, higher input costs and elevated uncertainty.

The employers national insurance threshold has been frozen. You’ll pay more as wages and salaries increase. The employers allowance however hasn’t been tinkered with and remains at £5,000, pretty handy for the smaller businesses amongst you.

There is much less help and certainty on energy prices than for your domestic bills. We feel for all of you running retail, manufacturing or hospitality businesses. The EBRS (Energy Bill Relief Scheme – the equivalent of the domestic cap) is to be subject to a review led by the Treasury to determine appropriate actions from April next year. The results of the review are to be published by the end of December. I suspect December 31 will be the date, when we all have other things on our minds.

Maybe the review should be led by BEIS. I quote from the treasury document “the overall scale of support the government can offer will be significantly lower and targeted at those most affected to ensure fiscal sustainability and value for money for the taxpayer”.

The VAT threshold – the point at which you must register – remains at £85,000. That’s fair enough, won’t affect many of you at all, and indeed it remains significantly higher than anywhere within the EU. In the past I’ve felt that lowering this to (say) £20,000 would significantly even out the playing field for micro businesses and sole traders, but to quote many motivational speeches in films, today is not that day.

The revaluation exercise for business rates will continue, and there will be significant extra support at the lower end of the scale. Business rates multipliers will be frozen in 2023-24, and upward transitional relief caps will provide support to ratepayers facing large bill increases following the revaluation. Relief for retail, hospitality and leisure sectors will be extended and increased, and there will be additional support provided for other small businesses.

R&D Tax Credits

Starting point – overall R&D budgets are not cut, but there’s acknowledgement, as we’ve said before, that there have been a number of fraudulent claims (“significant error and fraud”). The current process is too easy and the current rewards too tempting.

The few have spoiled it for the many.

In a rebalancing exercise, from April the SME scheme will be less generous, but RDEC (the large companies scheme) made more so to make it more competitive internationally. We’ll eventually end up with a single scheme, probably much like RDEC is today, and consultations are under way now to review that. We’ll probably find out more in the Spring Budget.

The SME deduction rate reduces from 130% to 86% and credit rate (i.e cashback rate) drops to 10%. No doubt there will be transition rules where the company financial year overlaps.

On the positive side, for SMEs intangible (data sets and cloud computing) costs will be able to be included.

Angel Investment

It’s very positive to see that the proposed improvements in SEIS and EIS have survived the mini-budget cull. From April, the SEIS investment limit rises from £150,00 to £250,000. The scheme further extends whereby the gross asset limit will be increased to £350,000 and the age limit from 2 to 3 years (from start of trading).

On the investor side, the annual limit doubles to £200,000. The 2025 sunset clause for EIS and SEIS has also been extended.

Innovation funds

Innovate UK programmes were allocated £2.6 billion. Funding for the UK’s nine Catapults will increase by 35% compared to the last 5-year funding cycle. This will allow Catapults to continue to support innovation and commercialisation. This includes the Offshore Renewable Energy Catapult centre in Scotland, with whom we have recently worked on their regional ORE accelerator based in Blyth.

HMRC processes

Related to R&D and other taxes, compliance measures from DWP and HMRC aim to raise £2.8 billion a year by 2027-28 through the recruitment of more than 6,000 additional staff. The OBR states that “This takes place in the context of cuts to growth in wider departmental spending that pose a risk to baseline compliance activity in the two departments”. We may see a broken department get even more broken, whilst also getting more aggressive.

In other news

By our very nature we tend to concentrate on the effects of taxation in this blog, but here’s a few other things from the November 2022 budget that you might need to know:

The government remains fully committed to COP26, and the proposed reduction in energy consumption – 15% by 2030 – remains our target.

Related to this, and to forward energy independence, further efforts are being made on the renewables side including provision for further nuclear power. Digital Catapult amongst other get a mention here.

Although some of the tax increases are to service debt, support for health, care and education services will increase fairly significantly. Health and Social Care combined will receive approximately £8bn extra per year.

Existing major Capex projects – such as HS2 to Manchester – will continue, as will the planned 5G and Gigabit rollouts.

Finally, in good news for your (grand)parents and possibly some of your family, the triple lock remains for pensions and they can expect a 10.1% increase in April. A similar increase applies to some benefits.

Need further help?

If you’d like to discuss what the November budget means for you and put together a plan for 2023, please do give us a shout. We’re here to help!