What do we know following the Chancellor’s speech? Here’s our take on it, if you’d like to read the Treasury’s full report it’s available here.

It is of course a balancing act, and one that I’m sure will please nobody at either end of the spectrum. The Chancellors focus is on the economy, and what we know is that between March and August the number of people in employment fell by 695,000, with many hundreds of thousands more currently predicted. Roughly 25% of businesses stopped trading completely at some stage.

The Autumn Budget

Possibly the biggest news (not so new news, but still) is the scrapping of the Autumn Budget. This, if anything, demonstrates the difficulty of forecasting the future. Forecasting is at the top of Blu Sky’s agenda as we and our clients attempt to plan the future, but I suppose ‘scenario planning’ would better describe what we are attempting to achieve.

Employment support

On to the detail, and the headline is confirmation that the Coronavirus Job Retention Scheme (CJRS) ends on October 31st as planned. This will be replaced, for a period of 6 months (i.e. until the end of April) by the Job Support Scheme (JSS).

The JSS appears to be pitched to supporting full-time workers who will work part-time (or part-time working fewer hours than before) due to a downturn in activity for their employers. It won’t save those still on full-time furlough.

It’s open to any small or medium business, and employees are eligible as long as they were employed yesterday (23rd September). The employee must work at least a third of their usual hours.

We don’t know yet if the ‘usual hours’ calculation will follow the same model as for CJRS – there’s certainly a different ‘start date’. Let’s hope the guidelines don’t go through as many changes as for that scheme.

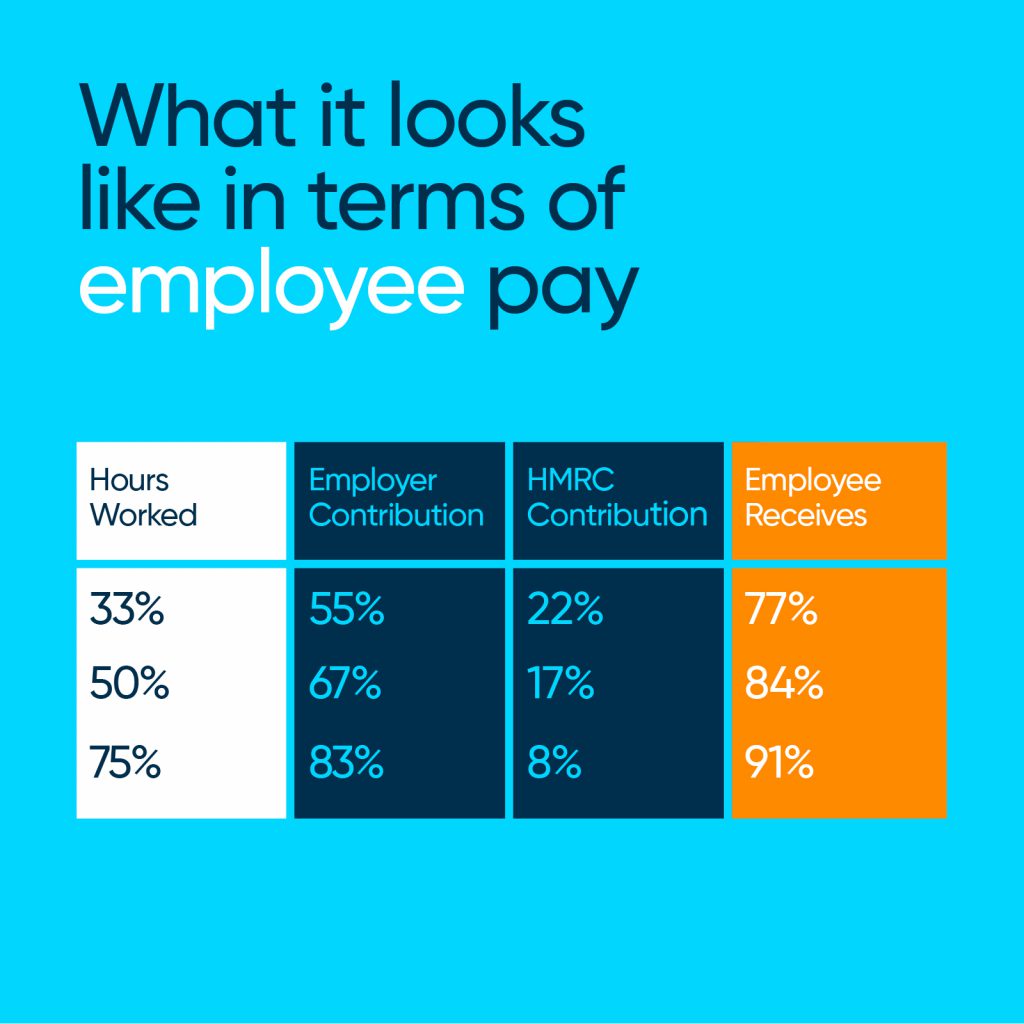

Under the scheme, for the hours NOT worked, the employer pays a third and the government pays a third (up to £697.92 a month). The following table shows examples of hours worked, cost to the employer, contribution by the government, and total received by the employee:

In effect, the lower the proportion of usual hours an employee works, the higher the hourly cost to the employer.

The employer will be reimbursed retrospectively. That’s an important difference from CJRS where the employer could claim upfront. We’ve no idea at the moment of the mechanics of the claim, but claim it would (or might) appear to be, so potentially, in that way at least, similar to CJRS.

We also need clarification on how employer’s national insurance and pension contributions may apply.

But hang on a minute. Orders are down, cash flow is tight, you need to put people on part-time work or make redundancies. I cannot see the motivation for an employer to do this, at an extra cost that may be unaffordable. 10 employees but only work for 5? Why would you not slim down to five full-time, rather than accruing the costs of almost 7 for 5 part-timers? Let’s wait for the social media debate here.

Maybe, just maybe, the other changes help on the cashflow side for businesses and make this more affordable. Let’s have a look:

Financial support

Repayments for the Coronavirus Business Interruption Loan (CBILs) and the Bounce Back Loan (BBL) can be extended from six years to ten. With an extension to ten, monthly repayments are almost halved.

Once six payments have been made, a one-off six-month payment holiday can be requested. Also, on three separate occasions, a six-month period of interest only payment can be requested. There will be no credit score impact.

The borrower must be ‘struggling’ to make repayments to receive these holidays. Let’s await a more formal definition of the word.

The application deadline for all schemes has been extended from this month until the end of November. A successor loan program will start in January, with further details to be announced.

Future Fund (FF) applications can also now be made until the end of November. If you already have a convertible loan through FF, don’t apply for a second.

The Self-Employed Income Support Scheme (SEISS) will be extended until the end of April under ‘similar terms and conditions’ to the new JSS. Doing the math this covers 20% (not 80%, or 70%, there’s an assumption you are working) of average monthly trading profits. Eligibility for the scheme remains as is.

The first grant will be paid out in a single installment covering 3 months’ worth of profits and capped at £1,875 in total. The second grant, covering February to April, will be reviewed and the cap fixed accordingly.

Taxes

If you deferred your March to June VAT payment until March 2021, that repayment can now be spread over eleven equal instalments throughout the 2021/22 financial year. No interest will be applied to the initial deferral. An opt-in process will be made available in early 2021.

The temporary reduction in VAT to 5% for some hospitality and leisure businesses is extended until March 31st.

Income Tax Self-Assessment, deferred from July until January, benefits from a similar extension to VAT in that up to £30k of tax, due now in January, can be spread over the following 12 months.

That’s it for now, we’ll clarify whats happening on the JSS once we know more. Many thanks and if you’d like to talk to us please email me on Dave@blusky.co.uk