Hello once again, and welcome to the Blu Sky analysis of what today’s announcements – and the detail in the documents supporting those announcements – mean to Blu Sky clients.

When I say ‘today’s’, there have been a fair number of pre-announcements coming from the Treasury in the past few days. Sufficient for the Speaker of the House to, let’s say, lose his rag and point out that any major policy announcements/decisions of that nature should go through the House of Commons first, rather than the front page of the Daily Mail.

This strategy was also, unusually, criticised by the ‘ways and means’ committee directly before the Chancellor delivered his statement.

Rishi, go to the naughty step!

The pre-announcements have mostly focussed on the good news side – where extra cash will be made available. Today has helped us understand where that cash will come from.

Let’s also understand the process here.

Although today’s announcements are policy decisions, much of what we hear won’t become law until it’s enshrined in the next Finance Act, which will go through the normal parliamentary process. With the current government majority there’s little chance of rejection, but during the process there’s always scope for minor amendments to be introduced.

Please forgive me if I deviate from today and slot a couple of other relevant gems in. And to go totally off-track, it’s pleasing to see some mask-wearing on both sides of the house on the day Keir Starmer has tested positive for COVID.

Anyway, lets bypass any political or economic statement – on with the show!

A quick summary

This was the ‘spending review and budget’ with very much a focus on the spending side, although this has been costed. As such, the tax impacts announced have been relatively benign and generally widely known.

The usual feared topics of changes to capital gains tax, business asset disposal relief (BADR, previously entrepreneurs’ relief) and pension tax relief bands have been bypassed. I suspect, however, there’s scope for changes to wriggle though before the end of the current tax year.

So don’t panic. You can relax whilst reading the rest of the document, although if you claim R&D tax reliefs I advise you to closely scrutinise the relevant section.

Inflation (CPI) is expected to average 4% over the next year, with an improved growth forecast from the OBR (Office for Budget Responsibility) of 6.5%. The inflation target of 2% was reiterated.

What does it mean for SMEs?

The dreaded – or welcomed, depending which side you’re on – online sales tax hasn’t happened. There will be further consultation.

Remember that the headline corporation tax rate increases to 25% from April 2023. We’re back to the future here. On the positive side the temporary £1 million level of the Annual Investment Allowance (AIA) is extended to 31 March 2023.

There are changes to the R&D tax credit scheme, detailed in the innovation/R&D section below.

There will be an extra 50% rates discount on business rates for many retail, hospitality and leisure businesses for one year. The rates multiplier will also be frozen in 2022/23, so an expected 3% increase shouldn’t happen.

From 2023 a new relief will be introduced so that qualifying property improvements won’t attract higher rates for a further 12 months. I’m guessing this is a tip of the hat to those who wanted the current VAT reduced rates to continue beyond March. Which they won’t.

The Recovery Loan Scheme will be extended until 30 June 2022. Finance will be available up to a maximum of £2 million per business. The government guarantee will be reduced from 80% to 70%.

There’s a substantial overhaul and simplification of alcohol duty, probably worthy of a separate blog if enough of you ask!

A quick summary is that duty will be lower for lower-alcohol content drinks, and higher for higher content. Sparkling wine will also be taxed at the same rate as still wines, so, import duties aside, your bottle of Prosecco may get a little cheaper. 3p off a pint expected. Cheers!

The planned rise in fuel duty has been cancelled in acknowledgement of current high prices.

Payroll costs are addressed in the next section.

What does it mean for employers?

Added costs!

We already know that employers NI will increase by 1.25% to 15.05% from April. The increase is ‘temporary’ and will revert to 13.8% from April 2023 – but at that point the Health and Social Care Levy of (at present) 1.25% kicks in.

National Minimum Wage increases by 59p an hour to £9.50 – a 6.6% increase – for those aged 23 and over. This means that an employee on NMW on 40 hours a week receives the equivalent of a salary of £19,760.

Bear in mind this isn’t too much higher than the anticipated inflation rate over the next year, so ensure your forecasts (a less than subtle hint there – if you don’t have a forecast, please speak to your Client Relationship Director) factor inflation in. Anything that involves transportation or energy (i.e. most physical goods) may see higher cost rises than even anticipated.

What does it mean for employees/individuals?

We already knew that employees NI would increase by 1.25% to 13.25% from April. The increase is ‘temporary’ and will revert to 12% from April 2023. At that point the Health and Social Care Levy of (at present) 1.25% kicks in, so the deduction from your payslip is permanent, it will just be described differently.

The rate of tax on dividends also increases by the same amount, so from 7.5% to 8.75% in basic rate, and from 32.5% to 33.75% at higher rate.

The National Minimum Wage increases by 59p an hour to £9.50 in April – a 6.6% increase. Remember that NMW doesn’t apply to Directors working without a contract of employment. It does apply to (almost) everyone else.

There’s seemingly substantial extra spending on health and education services, plus extra school places for special education needs, children social care, youth services, local football teams and affordable housing.

Some of this applies up north. None of this will go through a set of accounts we provide, but hey, founders and directors are people with families! I’ve not dropped any numbers in, because there’s a history of double counting in these areas (not aiming that comment at any one political party by the way).

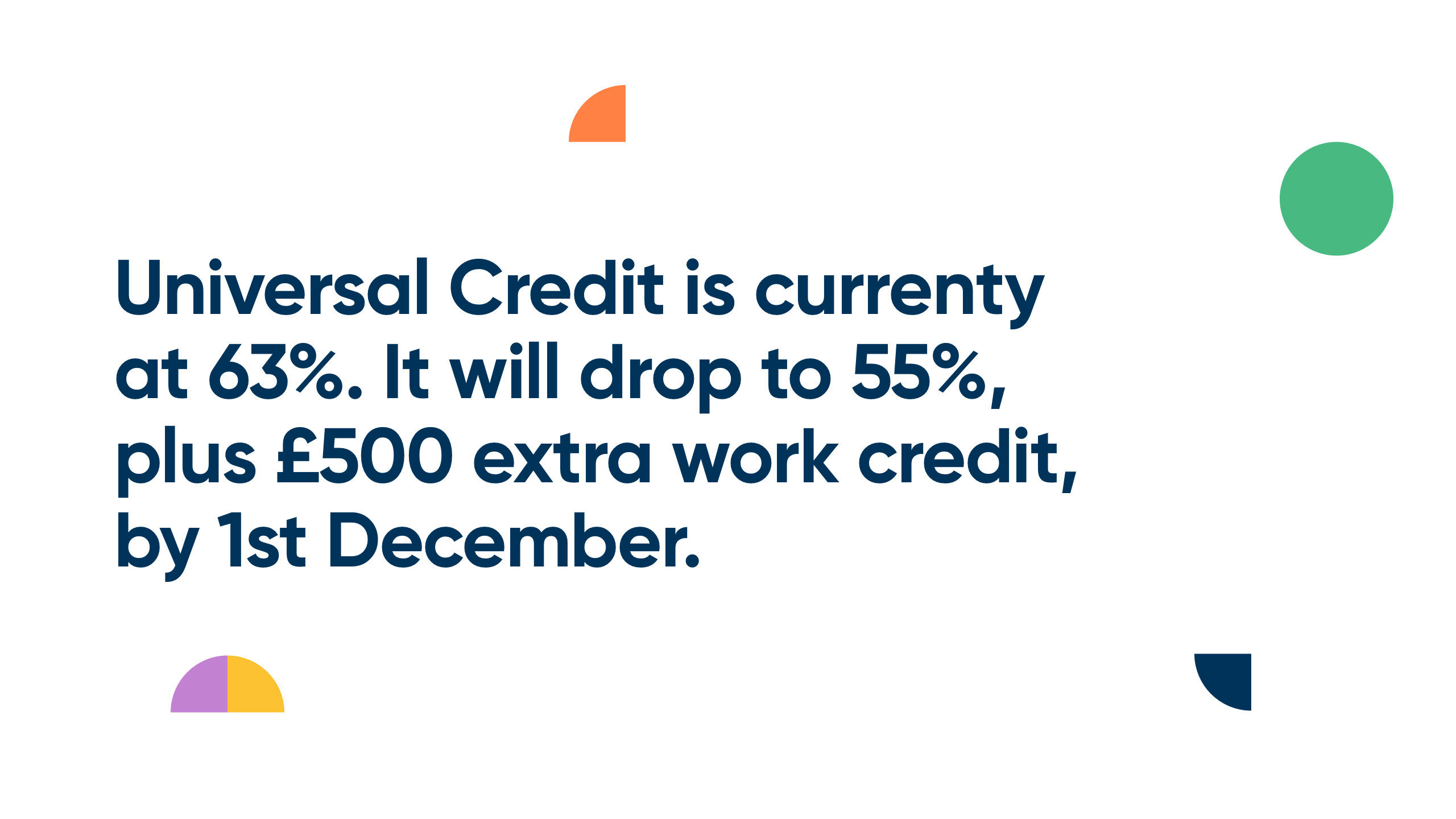

Finally, the Universal Credit taper rate, currently at 63%, will drop to 55%, this will be Introduced by December 1. There’s also an increase in the work allowance – before UC taper applies – of £500 a year.

What does it mean for sole traders and landlords?

If you’re a sole trader, expect reform to the income tax basis periods so that you’re taxed on income in the tax year itself, regardless of your accounting year. 2023/24 will be a transition year, so if you have an offset year end you might expect higher tax bills that year as a catch-up.

Alongside this will be MTD (making tax digital) for income tax which lands on our doorstep from April 2024 (a year later for partnerships). Seems a long way away, doesn’t it. What it means is that, in line with VAT, sole traders or property owners earning more than £10k a year must submit a quarterly return electronically, with an end of year balance.

The tax payment deadlines remain the same. For now.

Innovation, investors and R&D special…

Investing in R&D, on average, grows sales and employment 25% faster than comparable firms who don’t. R&D is a good thing, but UK businesses typically invest only 0.9% of revenues against an OECD average of 1.5%….

…bear with me here, many of these averages are meaningless in the context of tech start-ups, particularly when you are pre-revenue… this section will get more relevant towards the end.

A commitment to increase R&D spend

There’s a commitment to maintain increasing R&D investment by the government to £22bn by 2026/27 – a 50% increase on today’s investment – in addition to the cost of R&D tax reliefs. The Innovate UK annual budget will double to £1bn. Included in these costs are full membership of Horizon Europe.

A new investment fund

A new £1.4bn global Britain investment fund will invest in life sciences, offshore wind and automotive – extremely relevant industries in the north east. There’s also extra funding for the regional Angels program to help balance early stage equity finance across the UK.

There’s acknowledgement that an economy built on innovation must be open and attractive to overseas talent. 49% of the UK’s fastest-growing businesses have at least one foreign-born co-founder and approximately 40% of staff in UK fintechs are from overseas. In our experience we can certainly agree with those figures. From next year there will be three new visas aimed at attracting quality overseas talent.

There’s acknowledgement that an economy built on innovation must be open and attractive to overseas talent. 49% of the UK’s fastest-growing businesses have at least one foreign-born co-founder and approximately 40% of staff in UK fintechs are from overseas. In our experience we can certainly agree with those figures. From next year there will be three new visas aimed at attracting quality overseas talent.

There’s also investment in developing skills internally, with additional cash for technical skills and apprenticeships. The £3,000 apprentice hiring incentive is extended until January.

R&D tax relief reform

*Klaxon – important bit*: There will be substantial reformation of R&D tax reliefs, which generally feel sensible although these will further reduce claims for some of you on top of the PAYE cap introduced earlier this year.

The good news is that cloud and data costs can be included in R&D relief calculations.

There’s a ‘but’, and probably quite a large one: R&D tax relief was claimed on £48bn of spending in 2019, although it’s estimated that only £26bn of this expenditure occurred in the UK. From April 2023 UK based R&D will be ‘incentivised’ as opposed to overseas expenditure. There is no detail as to what that actually means, although it’s noted that other regimes, such as the US and Australia, do not offer relief at all for activities based overseas.

Those of you with overseas based development teams should brace yourselves for bad news.

The government will also set out plans to tackle abuse of, and improve compliance with, R&D tax reliefs later in the autumn. We know there’s a belief of widespread abuse and upscaling of claims, and we expect substantial process changes to be implemented within HMRC.

I guess ‘watch this space’ is the recommendation, or in particular, keep an eye on https://blusky.co.uk/category/blogs/ and remember that, yes indeed Blu Sky have substantial R&D experience – check out https://blusky.co.uk/r-d-tax-credits/.

What are HMRCs longer term plans?

HMRC are on a ten year mission to fully automate the tax calculation and collection process. Strategically, this makes absolute sense. Operationally, I can understand the nightmare scope of this if we consider it a single project.

Those who have dividend income that needs reporting are currently excluded from phase one of MTD for income tax. But don’t be surprised if, at some stage, something similar to RTI for payroll (i.e. real time reporting of payments) is also introduced for dividend payments.

There’s also talk of a change to the tax year, either to (probably) end on March 31, or December 31. I understand December 31 would be the Treasury favourite, in line with most of the rest of the world, but would entail significantly more change to HMRC systems. And potentially transition tax calculations. None of this will happen until after MTD for income tax is implemented.

There is to be reform of VAT (from April 2022) and income tax (2024) penalties, I’ll make sure we get another blog out on this topic.

So, lots happening, and in addition to the above there’s renewed vigour in tackling fraud. £292m provided to tackle the ‘tax gap’ and £55m for their Taxpayer Protection Taskforce whose remit includes hunting down abuse of the COVID-19 support schemes.

That’s it folks!

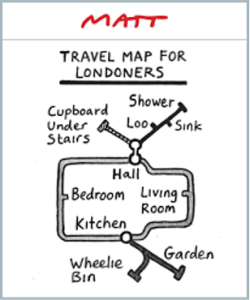

It’s traditional to slip a ‘Matt’ cartoon from the Telegraph in, so here we go: