If you’re looking for the 2023 Spring Budget Summary – You can find it here.

Well, there’s a lot to take in from today’s budget. As usual, Dave’s read all 130+ pages of it so you don’t have to. So let’s get to it, what are the main headlines from Rishi’s latest budget announcement?

What were our expectations?

Low as usual! It’s always difficult pinning down what’s going to happen, and this budget, in particular, is under somewhat different circumstances. Some tax somewhere was bound to go up, and it was odds on that Rishi would pull a rabbit out of a hat (and he did).

Writing a week ago, what we felt was nailed on was that job support would be further extended – probably until the end of June, the stamp duty holiday would be extended, again until June, and the extra £20 on Universal Credit would be extended by six months.

Some changes to claiming tax relief on pension contributions were more than likely to come in – this was on the table pre-Covid. And finally, the smart money was on us seeing the first step in increasing Corporation Tax from 19% towards the Chancellors preferred 25%, although this may not kick in until the autumn (CT is not tax-year dependent unlike income tax).

It felt more than possible that the VAT reduction in hospitality would also be extended. It’s certainly not giving any benefit today.

Now that we have genuinely Brexited, there was more scope to play with VAT. Changes to Capital Gains Tax had again been mooted pre-Covid, so we expected changes there, and also potentially to Business Asset Disposal Relief (Entrepreneurs Relief in old money). Neither of those will be in the right direction for business owners.

We predicted other possible revenue-raising tricks too – bearing in mind there was a commitment not to mess with the rates of income tax, national insurance or VAT. A freeze on the usual increase in income tax personal allowance would bring in cash by ‘fiscal drag’ – more people get dragged into the contribution band as wages rise (let’s not go there at a time of rising unemployment) and it could have been that the upper bands for employees’ national insurance increased.

What else might happen. Some tinkering with R&D schemes? A tightening of the rules around SEIS and EIS? Certainly, finally, and it is already there, a renewed appetite for chasing tax debt after a few months of softer management, and maybe a more punitive penalty regime. Watch out also for Investigations into CJRS fraud, we suspect HMRC see a great potential for cash claw-back here.

As time drew closer to today, the leaks became increasingly obvious, so in the end there were few real surprises. Let’s see what he came up with…

What are the headlines?

We’ll start with a sobering confirmation of statistics.

700,000 jobs have been lost in the last year and it’s no secret that the 9.9% GDP drop in 2020 was the biggest drop in the three centuries since records began.

It’s been a tough year, but if we still have our health, our family and our business – let’s count ourselves lucky. Vaccine roll-out will help speed the recovery up, but the Bank of England forecast is only for 5.5% growth in 2021. The vaccine won’t, of course, address any Brexit-related issues.

The GDP drop is accompanied by an associated drop in tax revenue for the Treasury, who have then borrowed even more to fund the coronavirus-related help. The last time we borrowed this much was between 1939-45, and I’m sure we all know what happened then.

The OBR (Office for Budget Responsibility) predicts we’ll be back to 2019 by mid-2022, 6 months earlier than previously thought.

Covid-related borrowing by the government is expected to hit £355bn this year. To put that in perspective…

Let’s say you are on a salary of £25,000. Borrowing in total was 16.9% of GDP, so you borrowed an extra £4,225 in the year. Your underlying debt now stands at 97.1%, so you owe a total of £24,275. You’d want to reduce that, wouldn’t you.

OK, enough of the boring economics, on to the detail, tax changes, and what it means to you.

Coronavirus Support

CJRS

CJRS has helped 1.3m businesses and supported 11.2m jobs.

The CJRS scheme was extended for a further five months, albeit with a revised tapering effect (down to 70% in July, 60% thereafter), until the end of September.

That’s good news for employers and employees in genuine difficulty, or those that will need an extended led-in once trade restarts – although the employer must contribute to top up the reduced grants to 80% of normal salary. The calculations change again, sorry, Blu Sky Payroll team!

At the risk of repeating myself please please PLEASE don’t be tempted into claiming for employees who have returned to work. There are rules, stick to them. There are already tens of thousands of HMRC enquiries floating about on this topic. Read the tax avoidance section for more on that.

A final thought, we suspect the extension to September takes into consideration that some restrictions may last longer than the ‘earliest dates’ announced.

SEISS

Also to continue until September is the Self Employment Income Support Scheme, with a 5th and final grant covering May onwards. For those where turnover has fallen 30% or more, the full grant is available. If less than that, there is a reduced 30% grant.

Previously, the newly self-employed didn’t qualify, but if a 2019/20 tax return had been filed by midnight yesterday, the 4th and 5th grants can be claimed.

Tax avoidance, evasion and penalties

New HMRC task force

“The government will invest over £100 million in a Taxpayer Protection Taskforce of 1,265 HMRC staff to combat fraud within COVID-19 support packages, including the CJRS and SEISS, representing one of the largest responses to a fraud risk by HMRC. In addition, the government will raise awareness of enforcement action in order to deter fraud, and will significantly strengthen law enforcement for Bounce Back Loans”.

Make sure you do it right, people.

VAT and Income Tax penalties

Interestingly, tucked in the document but not referred to in the speech, reforms to VAT and Income Tax self-assessment penalties will come into effect from April 2022.

This has been talked about for a long time, with VAT penalties being somewhat punitive compared to other tax penalties. The aim is to make the penalties fairer and more consistent raised on a points-based system (possibly similar to the way PAYE penalties work).

R&D SME scheme claims

As

previously announced, for accounting periods (i.e. financial years) beginning

on or after 1 April 2021, the amount of SME payable R&D tax credit

that a business can receive in any one year will be capped at £20,000 plus

three times the company’s total PAYE and NICs liability.

What it means to entrepreneurs and owner-managed businesses, including corporate taxes

Corporation tax (CT) and capital allowances

From April 2023 CT will rise from its current level of 19% to 25%. This applies to profits of £250,000 or more. Profits of £50,000 or less will continue to be taxed at 19%, and the band in between will be taxed on a tapering basis. Back to the future here.

There will be an extended loss carry back for businesses, up to £2m carry back in the next two years, but with more detailed rules for group structures.

These are still comparatively low rates for businesses compared to the EU and US.

From April until March 2023, if investing in ‘qualifying plant and machinery’ there is a new ‘super-deduction’ of 130% of the cost. This potentially cuts the corporation tax bill by 25% of every £1 invested. The OBR judge this will increase the level of business investment by approximately 10% at its peak in 2022-23, equivalent to around £20 billion per year.

Training and Education

Many SMEs will be offered subsidised MBA-style training from ‘top business schools’ from June.

£520m has been set aside for this. We await the small print with interest, but you can register your interest at https://helptogrow.campaign.gov.uk/

Allegedly one reason for the UK’s relatively poor productivity performance is the low usage of technology and best practice. The UK has relatively low adoption of digital technologies and software compared to international competitors while UK SMEs are less likely to use formal management practices than SMEs in peer countries.

Our belief is that, in the main, Blu Sky clients are fairly switched on here, but this is well worthwhile taking a look at.

Apprenticeships and jobs

There will be extra funding for apprenticeships, more a case of topping up the existing system rather than introducing a new process.

In our opinion and experience, the Kick Start scheme needs a further kick. As of January (4 months in) the headline figure of 120,000 jobs had been ‘created. But DWP statistics show less than 2,000 young people had begun their placements as at 15th January.

We can say, from an end-user point of view, the process is frustrating. No doubt substantially more so if you’re unemployed and waiting for a placement.

Loan Schemes

A new recovery loan scheme (RLS), replaces BBL and CBILs, and can lend from £25k to £10m. It’s available until December.

The Treasury underwrites an 80% guarantee to lenders. This will be available even if you have existing supported lending.

Option schemes

There is a ‘call for evidence’ on whether and how more UK companies should be able to access EMI to help them recruit and retain the talent they need to scale up.

VAT

It’s confirmed there is the ability to further delay deferred VAT repayments from last year, so this can be paid in 11 equal amounts from this month rather than in a lump sum.

The VAT registration limit will stay at £85,000 until 2023/24.

What it means to employees and personal taxes

Tax bands

We thought personal allowance and tax bands may be frozen. Well, they are, but the 2021/22 increases will happen first, then bands will freeze from that point up to and including 2025/26.

Inheritance tax thresholds and pensions lifetime allowances (about £1.073m) will follow the same pattern.

The Capital gains tax threshold will remain at £12,300 until 2025/26 (there was a strong rumour this would be substantially cut and that the rate would increase).

- Personal allowance therefore rises to £12,570 then freezes.

- The higher rate bands increases to £50,270 and then freezes.

- National insurance contributions increase in line, then freeze.

- * income tax bands here refer to England Wales and Northern Ireland.

The National Living Wage increases to £8.91 from April.

Moving house

Let’s throw stamp duty into this section. The stamp duty holiday has been extended by three months until the end of June. Then nil rate band is then reduced from £500k to £250k from July until September, returning to previous £125k level on October 1st.

95% mortgages will be under-written (ever tried to get a mortgage these days? Not as easy as it was) albeit individual lenders will no doubt have a say here. The Mortgage guarantee scheme is for properties up to £600k in value. Most high street banks will be offering this from April, with other lenders to follow soon after.

Other stuff!

In no doubt popular news, there is no increase in fuel duty and alcohol duty.

What about Tech businesses?

State Aid and R&D

There will be a review of R&D tax reliefs (both schemes) to ensure they are fit for purpose, from a competitive viewpoint and ensuring taxpayers money is fairly targeted. In conjunction with the salary cap mentioned earlier in this document they are clearly a little uncomfortable in its current focus. ON the bright side they will consider the future inclusion of data and cloud computing costs.

There were no stated changes to the (S)EIS regime, but the announcement of a new £375 million fund to help scale up the most innovative, R&D intensive businesses.

Talent

There will be a fast track visa scheme to bring in overseas

talent, starting in April 2022. That

doesn’t necessarily encourage overseas entrepreneurs to set up their business

in the UK though.

What about the hospitality trade and bricks and mortar retail?

‘Restart grants’ of up to £18k will be available through local authorities from April for hospitality/gyms etc. As non-essential retail opens earlier, their grant is restricted to £6k.

100% Rates relief for eligible retail hospitality and leisure businesses remains until June, then is discounted by 2/3 for the rest of the financial year.

The VAT reduced rate for hospitality extended until 30th September, then 12.5% for a further 6 months.

Contactless payment limits will increase to £100 ‘later this year’ from its current £45 level.

What else is happening?

From the 23rd march there will be a set of consultations on tax reforms.

These are normally announced on budget day, but “Several consultations are an important part of the government’s 10-year tax administration strategy to create a tax system fit for the challenges and opportunities of the 21st century…..We are making these announcements separately to the Budget, but still all on a single day, in order to give a range of important but less high profile measures greater visibility among Members of Parliament, tax professionals and other stakeholders, and greater scope for scrutiny by them.”

…we’ll get them identified to you on the day.

SME Brexit Support Fund

The government have launched a £20 million SME Brexit Support Fund which offers support to help small businesses to adjust to new customs procedures, rules of origin and VAT rules when trading with the EU.

Applications open in March, and we will update the North East Growth Hub when they do.

The SME Brexit Support Fund could give you up to £2,000 if:

- your business has up to 500 employees

- no more than £100 million annual turnover

- you trade only with the EU, and are new to importing and exporting processes

The UK Infrastructure Bank

Will be based in Leeds and therefore deserves a mention. It will have £12bn capitalisation.

And finally…

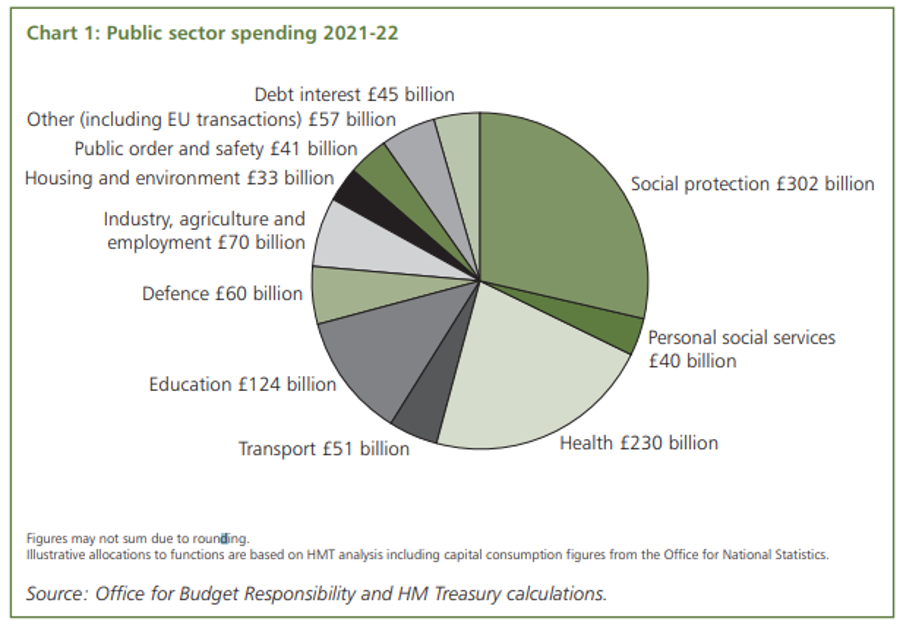

It’s always interesting to look at income and expenditure – we are accountants after all. The following are lifted from the Treasury Budget Report:

Need advice?

We’re always here to answer your questions on what the budget means for your business in practice. Get in touch if you need a chat: info@blusky.co.uk.