“Pay day” is the day that every employee looks forward to. Therefore, getting payroll correct is the most important thing for employers to keep their employees happy. So what process should be followed in order to maintain employee happiness as well as meeting filing deadlines? Matt Booth explains…

What should you do?

You need to ensure your payroll provider receives the correct payroll information in a timely manner. This will include any new employee forms, additional commissions and further deductions, and means that your payroll provider can process your payroll without delay.

You should also forward any correspondence regarding payroll for an individual employee to your payroll provider. A common example of this is tax code notices from HMRC – they go directly to the employee or employer, and not always to your accountant.

What does your payroll provider do?

Your payroll provider will need to process the information provided. They will assess whether an employee is being paid the national minimum wage and keep an eye out for employees that need to be enrolled onto any pension schemes. They should make sure you stay compliant with HMRC and the pension regulator.

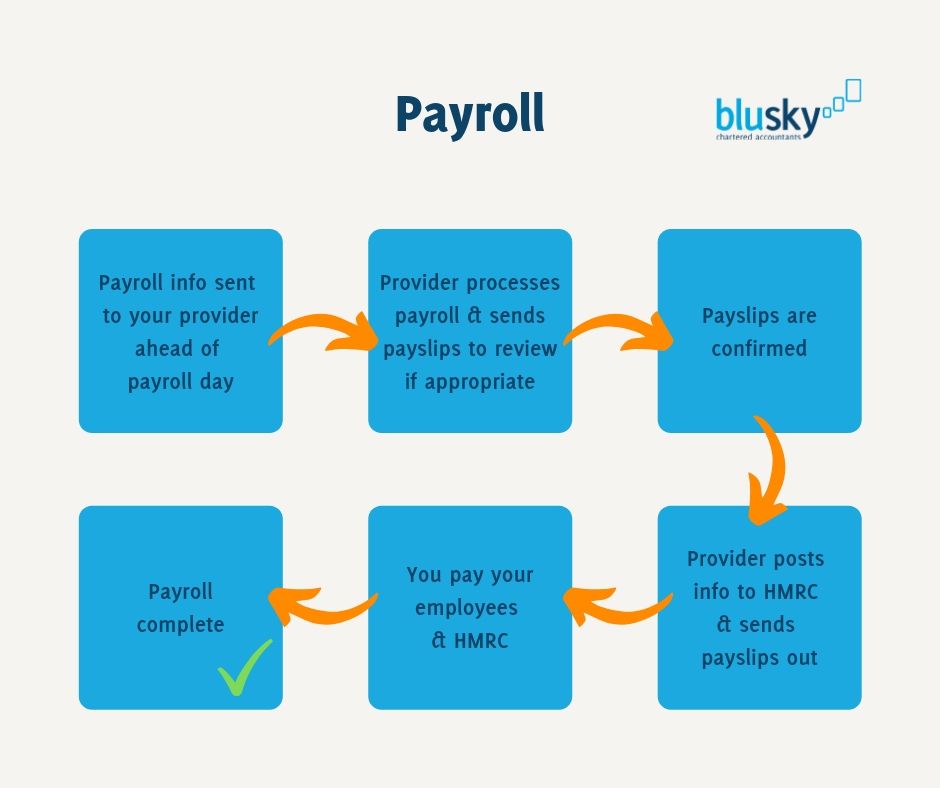

Flowchart of the process

If you’d like a chat about how we can help you with your payroll, get in touch!