- What is the Cycle to Work Scheme?

The cycle to work scheme is a tax-free benefit introduced in 1999 to help promote a healthier option than driving to work. An employee is able to get a bike and/or equipment (usually between the value of £100 – £1000) tax free by going through their employer that is registered under the Cycle to Work Scheme. As well as driving down pollution, the employee is taking part in a healthier lifestyle.

- How does the Cycle to Work Scheme work?

First thing to do if you are interested is to find out what scheme you’d like to offer as an employer. Your employees who wish to take up this benefit will then need to apply for a certificate which they can take to one of the registered bike shops and redeem for a bike or equipment of that value. Their salary sacrifice, ie a salary sacrifice taken off their payslip in a similar way to pensions or childcare vouchers, will be deducted from the next pay run.

Some stores offer different policies, for example Evans and Halfords operate their own Schemes so it’s worthwhile checking which you’d prefer to offer.

- Is it just like a finance agreement between an employer and employee?

Yes, in terms of paying a company for an asset. Until the minimum payments have happened, the bike remains yours as the employer. You may wish to agree on a transfer of ownership for the bike to belong to your employee after so many payments, but this is between you and your employee, so ensure you have a policy on this.

- How much value can employees apply for?

The scheme allows employees to spend up to (usually) £1,000 on a new bike along with any equipment they may need. You might decide to offer more, but this is your call as the employer.

- Can employees join the Cycle to Work Scheme at any point?

Yes. There are no legal guidelines but as an employer, you can set out policies on this. You may require employees to be employed past their probation period, or you might want to tie the benefit in with a holiday year.

- Can anyone join the C2W scheme?

In order for the cycle to work scheme to be a tax free benefit, the scheme must be open to all employees and mainly used (50%+) for getting to work.

- Will joining the scheme affect employee pensions or other benefits?

An employee joining the Cycle to Work Scheme shouldn’t affect their pension. This is because pension is calculated on gross pay rather than net pay. Generally speaking, the Cycle to Work Scheme shouldn’t affect any benefits unless wages dip below National Minimum Wage – if so, as an employer, you would need to cease payments until the employees regular earnings are back above NMW.

- Is it just bikes that can be bought?

No! You can buy equipment that is necessary for cycling. For example, a helmet, pump, high-viz jackets, inner tubes and bike cleaner are all allowed.

- Can I buy more than 1 bike?

Your employee can buy more than one bike but this is only in circumstances that require the employee to have two bikes. For example, if your employee can’t take their bike on the train and therefore needs a bike for both journeys (to the train from home, and from the train to work, and vice versa).

- Where can the bike be purchased from?

Retailers must be a registered cycle to work providers. A few examples are: Evans Cycles, Halfords & Cycle Centre.

- Who owns the bike during the scheme?

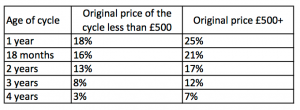

As an employer, you own the bike. However, the employee can buy the bike from you at the end of cycle to work scheme, at a “fair market value”. Make sure you have a policy on this! A suggested fair market value table is below.

12. What if I leave early or am made redundant?

If an employee was to leave the scheme early, they would no longer be eligible for the tax advantage. Since the bike is technically owned by the employer and the employee was to leave, then you as the employer may wish to keep the bike. It could be used as a pool bike for your other employees. In most cases, an agreement is put in place and the remaining amount is deducted from the final pay check, transferring the ownership of the bike to the employee. This depends on your company, so be sure to have a policy in place.

13. Who owns the bike at the end of the hire period?

As an employer, you own the bike at the end of the hire period unless you agree with the employee that they will buy it from you at the end of the scheme at a “fair market value” which HMRC has determine to be:

| Age of cycle | Acceptable disposal value percentage | |

| Original price of the cycle less than £500 | Original price £500+ | |

| 1 year | 18% | 25% |

| 18 months | 16% | 21% |

| 2 years | 13% | 17% |

| 3 years | 8% | 12% |

| 4 years | 3% | 7% |

| 5 years | Negligible | 2% |

| 6 years and over | Negligible | Negligible |