Are you looking for a tool, process or software to help with a business challenge but just can’t find anything out there? If that’s the case, use this opportunity to develop your own solution: start an R&D project!

Best of all this project could be eligible for an R&D Tax Credit, which if your claim is successful could save you thousands in corporation tax or even get you some cash back in the bank from HMRC!

A lot of our clients have now claimed and it hadn’t crossed their mind that the scheme would be open to them. There is a strict set of criteria, but have hope! It’s all about supporting businesses with innovation and is a great way of encouraging this within UK: so take advantage if you can.

What are R&D Tax Credits?

R&D Tax Credits are a Government fund which allow businesses to utilise some of their R&D costs for tax relief for projects that aim to advance science or technology.

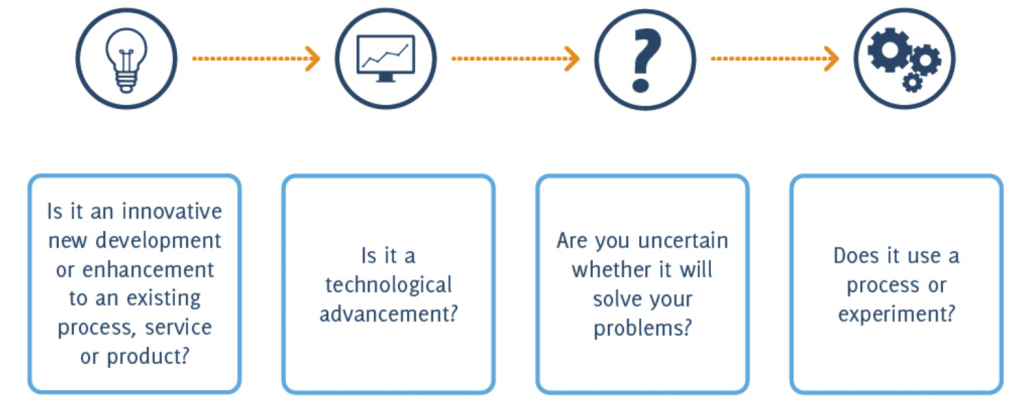

Your R&D project could relate to improving or developing new processes, services or products based on a problem you’ve stumbled upon. It can even be to enhance an existing set up if you want to do something in a new way and your innovative use of science or technology will make it more efficient!

Now that doesn’t mean you can claim for just developing your product as you planned: the project solution needs to be innovative, something that’s new and doesn’t exist within your industry yet and will solve a problem if it works. Plus you need to intend to use the results to move forward with your business.

A key element of the fund is that you must be ‘uncertain’ about whether technology or science will solve the problem – but you’re going to try. You need to consider whether you, or a competent team member could look at the problem you have, and get to the solution with time and investment. Also find out if other people within your industry have common knowledge that could solve the problem. If the answer to any of these two situations is yes then you won’t qualify because the project isn’t based on technological uncertainty, they are routine uncertainties.

Here are some client examples of R&D projects that have been claimed for:

- A print business was asked to print a different design onto a client’s scratch card, which meant they needed to use gold rather than silver ink. The business had standard print machines so the ink needed to pass through those without causing damage, while still meeting the criteria the scratch card needed to be legal (transparency, durability, security). After research they couldn’t find a suitable ink so began an R&D project to see if they could develop the ink needed to match all the criteria.

- A manufacturing business needed to print a new design in a specified colour onto a plastic base. The existing methods and ink’s didn’t have the correct properties to make the ink “stick”. After research the company couldn’t find any solution so started a project to find the correct composition of ink and process improvements to ensure the correct binding of the ink

- An architect passed designs of a large roof over an open central hall area. The design was very unique and had minimal support visible, which caused a problem when it came to constructing the roof. The design would be very unstable if built using conventional methods, and after research the architect still couldn’t find a solution. They started a project to find a new structural assembly process which would also solve the load bearing issues to bring the roof design to life.

- A creative agency had grown to a scale where client management had become cumbersome, and communication was across various tools. They needed one system that had a client view, and internal view and allowed design files to be uploaded and comments to be made and that was also custom to their monthly package structure. There was nothing available that could fulfil this so they started a project to develop their own tool specific to the industry.

All of these claims were successful with each business receiving chunky tax reductions which enabled investment and growth in the businesses.

SME or RDEC scheme?

There are 2 schemes up and running: SME (typically for small businesses) and RDEC (typically larger businesses). If you’re business is loss making you can claim back as a cash repayment from HMRC up to 33p in every £1 spent on your R&D project with the SME scheme, and 9p in every £1 spent with the RDEC Scheme.

Or if you’re making profit you can reduce your corporation tax bill by 26% of your R&D spend with the SME scheme, or 11% with RDEC.

To determine which scheme you can apply for you need to look at the criteria below and see where you fit based on your company size.

Beware of some grants if considering claiming R&D Tax Credits

If you plan to claim SME R&D tax credit, and this will be a greater value than a grant you’re offered don’t take the grant. You won’t be eligible for R&D tax credit if you’ve already received ‘notifiable state aid’ for the project as the SME scheme is also ‘notifiable state aid’ (ask the grant provider if you’re not sure if it’s notifiable or not).

However if you’ve already claimed ‘notifiable state aid’ you may still be able to claim RDEC at the 9p per £1 lower rate. The most common ‘notifiable state aid’ we see if the Innovate Smart UK Grant.

What industries qualify?

- Engineering

- Software & Tech

- Environmental sciences

- Life sciences

- Manufacturing & Design

If you have a linked or partner company it can get more complex

Linked company: If the linked company has a 50% (or more) share, the values from both companies must be combined .That may bring you above the limits of the SME scheme as you’ll fit in the ‘large company’ size, so you’d need to claim RDEC at 9p, not 33p per £1.

For example the company you’re doing the R&D for has 100 employees, and the linked company has 600 so combine that and you’d fit into a large company/RDEC scheme with a head count of 700. But if the linked company had 300, then the combined head count would put you in the SME band.

Partner companies: If 25% or more of your company is owned by someone else, or if you own 25% or more in an additional company them these would be classed as a partner company. In this case you need to take the % owned by/or in the other company and add the values together based on that % to see which scheme you fit into.

For example if the other company controls 35% of the company your claiming R&D for then you need to add 35% of the values (employees, turnover and balance sheet total) and you’ll see if you can claim on the SME or RDEC.

It’s worth still checking this in detail with HMRC or your accountant as there are certain companies and types of investor that are excluded from being consideration as a partner.

If you don’t have any linked or partner companies don’t worry about the above.

What can be claimed for the specific R&D project?

Great news – a lot fits into the claim! Here’s a run down of the main costs (always double check as there are more):

- Employee costs specific to the R&D project

- (salaries, employers NIC, reimbursed expenses that have come direct from the employees pockets & employers pension contributions)

- Spend on Externally Provided Workers (people who operate through an external provider instead of contracting directly with your company as individuals: such as freelancers, agency staff, contractors (65% allowable)

- Unconnected subcontractors (65% allowable on SME scheme. The RDEC scheme has more restrictions and it doesn’t usually qualify but there are some exceptions so ask your accountant)

- Materials & consumables used including lighting, power & heat (this can get tricky if your consumables are included within your rent).

- Specialised software

- Cost of clinical trials

- Prototypes

What costs do NOT qualify?

- Capital expenditure like land, buildings, and equipment

- Patent or trademarks

- Production and distribution of goods or services

- Telecommunication and data

- Shareholder dividends

- Any benefits in kind, such as private medical cover or company cars

- Pure product development

Next steps

The deadline for submitting your claim is 24 months after the accounting period ends. Remember you can still apply even if the project isn’t successful: you undertook the research and proved it couldn’t be done (not the best outcome but at least you can get some costs back).

Keep R&D tax relief front of mind and think about any advances you could make within your business that could apply. Speak to your accountant early and they’ll make sure you’re on the right track.